Nebraska – Thank You for Joining US!

We are blessed to call Nebraska home and are excited to continue to serve our local communities with the partnership with the Nebraska Independent Community Bankers (NICB). Below are written answers to some of your questions asked during our FREE Forum.

But first please take a moment to learn about the NICB and Banker’s Compliance Consulting.

Hear more testimonies from Banker’s Compliance Consulting customers

Here are written answers to a few of your questions asked during the Forum!

Question. In 2019, we did some loans to a couple of individuals secured by rental properties owned by an LLC. We’re now looking at new loans to the LLC secured by the same properties. We’re wondering how to report the purpose of these new loans for HMDA. The LLC has had and is maintaining ownership of the properties and no borrowers are the same. Should the new notes be reportable as purchase, refinance, or other loans?

Answer: Since there is no transfer of ownership and none of the borrowers from the previous notes are the same, the new notes would not be reportable because they are business purpose home equity loans, which aren’t reportable.

Question. Is it okay that the interest rate and APR on our HELOCs match, even though we charge fees?

Answer: This can be confusing because the rules for open-end credit are different than the closed-end side. It is okay that the interest rate and APR match on your HELOCs. Your application disclosure and agreement should both indicate the APR only includes interest and not other costs.

Question. Could you discuss the flood remapping process and what property owners may want to be doing ahead of time? We’ve heard it’s cheaper to buy flood insurance now, before moving into a Special Flood Hazard Area (SFHA).

Answer: It is cheaper to buy a flood policy prior to a property moving into an SFHA because of a “grandfathering” option. To qualify, the policy must be in effect when the new maps become effective and continuous coverage must be maintained. It may even be transferred between owners.

Question. Does the Safe Act require use of the NMLS # on HELOCs? I know the NMLS # is required on all applications, TRID Disclosures, notes and deeds of trust/mortgages for purchases and refinances but is it required on a HELOC?

Answer: HELOCs are subject to the SAFE ACT’s NMLS # disclosure requirements.

The SAFE Act requires use of the NMLS # 1) Upon request; 2) Before acting as an MLO; and 3) Through initial written communication.

Regulation Z actually requires the NMLS # to be on the application, TRID disclosures, note, deeds of trust/mortgages for all closed-end consumer credit transactions secured by a dwelling. So, the NMLS # does not need to be on a HELOC application, disclosure, note, or security document.

Didn’t get in on the hour-long Q & A session? You can access a video of it here – https://store.bankerscompliance.com/link/NICB7-20.

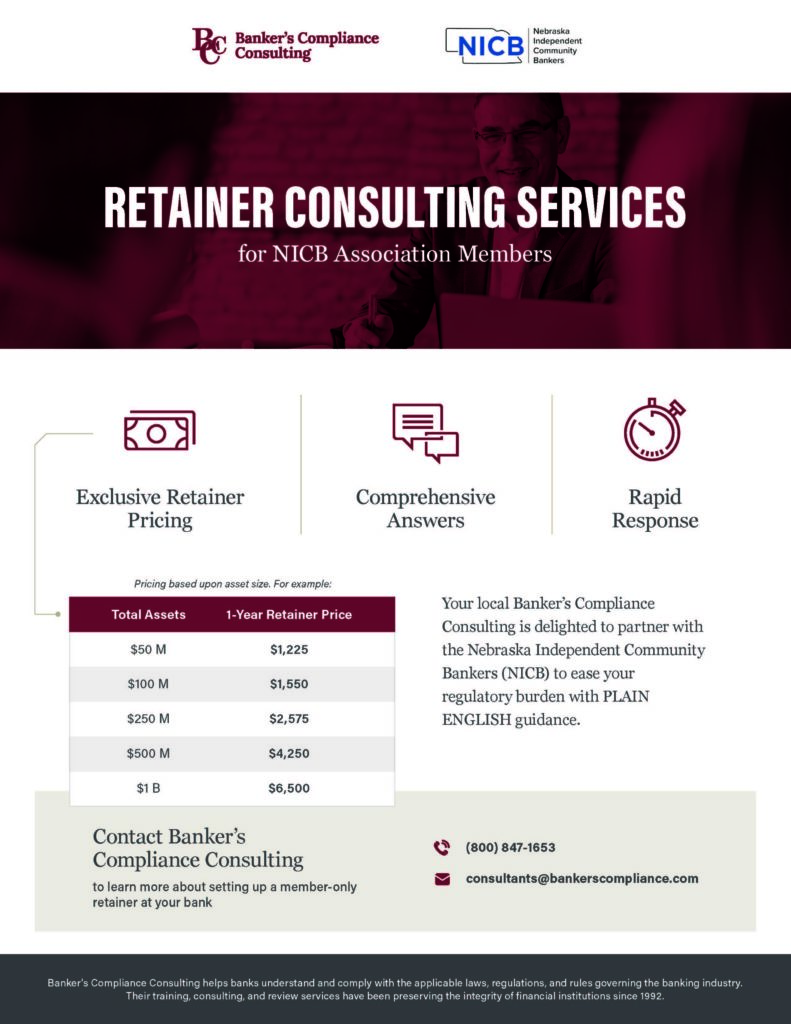

Don’t forget the Exclusive Retainer Pricing offered to members of the NICB.

Ready to sign up?

Contact us at –

consultants@bankerscompliance.com

800-847-1653

Not a member of the NICB? Contact them at 402-474-4662 or info@nicbonline.com for more information on membership benefits. You can also check out their website here – https://nicbonline.com/.

Jamie Gustafson

Jamie wears many hats at Banker’s Compliance Consulting. These include managing the administrative team and heading up the e-commerce division. Jamie incorporates her experiences as a former Sergeant in the military and small business owner to bring an energetic and passionate approach to all opportunities! She has a Master’s Degree in Organizational Management and will graduate with her Ph.D. in Business – in May 2023. When Jamie is not directing at BCC, she dabbles in hobbies such as soap and cheese making.