CDD/BO MANAGEMENT & BOARD CHECKPOINTS

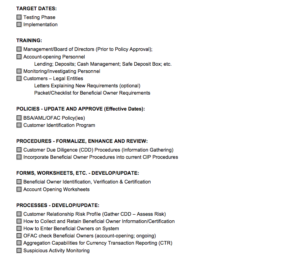

The May 11, 2018, mandatory compliance date is fast approaching for the “strengthening’ Customer Due Diligence and  the new Beneficial Owner rules. Will you be ready? Where are you at with your action plan? Have you thought of everything? Will you have time to test your process before implementation? Are you keeping Management and the Board apprised of your progress? Have you trained the Board on the major requirements of the new rule? Don’t forget to do this BEFORE you submit the updated BSA/AML/OFAC Policy and Customer Due Diligence Program for their approval. The Board needs to be informed and knowledgeable of the regulatory requirements in order to approve Policy and to provide direction for the BSA/AML Program; after all, they are ultimately responsible for the bank’s BSA/AML compliance! To help you out, we’ve put together a list of checkpoints (see below) to keep you on track and to keep your Management and Board informed.

the new Beneficial Owner rules. Will you be ready? Where are you at with your action plan? Have you thought of everything? Will you have time to test your process before implementation? Are you keeping Management and the Board apprised of your progress? Have you trained the Board on the major requirements of the new rule? Don’t forget to do this BEFORE you submit the updated BSA/AML/OFAC Policy and Customer Due Diligence Program for their approval. The Board needs to be informed and knowledgeable of the regulatory requirements in order to approve Policy and to provide direction for the BSA/AML Program; after all, they are ultimately responsible for the bank’s BSA/AML compliance! To help you out, we’ve put together a list of checkpoints (see below) to keep you on track and to keep your Management and Board informed.

Also, if you’re looking for additional training on the Customer Due Diligence and the new Beneficial Owner rules, we’ve got you covered. On February 7, 2018, we will be offering a 2-hour webinar on Customer Due Diligence Programs & Beneficial Owners and then on April 4, 2018, we will be offering a 1-hour webinar on Customer Due Diligence & Beneficial Owners for Commercial Lenders.

Published

2017/11/30

Deb Irving

David Dickinson

David’s banking career began as a field examiner for the FDIC in 1990. He later became a Compliance Officer and Loan Officer for a small bank. In 1993, he established Banker’s Compliance Consulting. Along with his amazingly talented Team, he has written numerous compliance articles for prestigious banking publications and has developed compliance seminars that Banker’s Compliance Consulting produces.

He is an expert in compliance regulations. He is also a motivational speaker and innovative educator. His quick wit and sense of humor transforms the usually tiring topic of compliance into an enjoyable educational experience. David is on the faculty of the American Bankers Association National Compliance Schools and has served on the faculty of the Center for Financial Training for many years. He also is a frequent speaker at the ABA’s Regulatory Compliance Conference. He is also a trainer for hundreds of webinars, is a Certified Regulatory Compliance Manager (CRCM) and has been a BankersOnline Guru for many years. The American Bankers Association honored David with their Distinguished Service Award in 2016.

David and his wife Karen have three adult children, four grandchildren (none of whom live at home!) and two cats (of which Dave is allergic … the cats, not the children!). They recently moved to an acreage outside of Lincoln, Nebraska where he gets to play with his tractor. When possible David can be found fishing, making sawdust in his shop, or playing the guitar and piano. He also enjoys leading worship at his church.